The TBESS will provide support to businesses impacted by the increase in energy costs. If you are operating a trade from business premises and have an MPRN or GPRN, it is likely that your business will qualify for the cash benefit. The benefit will be calculated by reference to a calendar month and is expected to run from September 2022 to February 2023.

The following is a summary of the key features followed by a couple of examples. No claim should be made without reading the full Revenue guidance which can be found here.

https://www.revenue.ie/en/starting-a-business/documents/tbess-guidelines.pdf

Some of the key features of the scheme are as follows:

- The business must be able to demonstrate that the average unit price for electricity or natural gas in each claim period has increased by 50% or more as compared to the average unit price in the reference period

- Average unit price – Total bill charges, exclusive of VAT, divided by the number of units of electricity or gas consumed during the period covered by the bill.

- Claim period – Each calendar month within the intended operation of the scheme from September 2022 to December 2022 (likely to be extended to February 2023).

- Reference period – The reference period is generally 12 months prior to the month to which the relevant bill relates. For example, a September 2022 claim period will be compared to a September 2021 reference period.

- Business must be tax compliant and be eligible to obtain a tax clearance certificate.

If all of the conditions of the scheme are met a business will be considered eligible and will qualify for a cash payment of 40% of the year-on-year increase in their energy or natural gas bills for each claim period.

There is a cap of €10,000 per trade or €30,000 where a business operates across multiple locations. Businesses need to be mindful of amounts charged on an electricity or gas bill for a claim period that is not expended wholly and exclusively for the purpose of the trade or profession of the eligible business. An example here would be where the business premises has a domestic dwelling attached to it. There are additional conditions that groups need to be aware of as set out in the manual.

Businesses will need to Register for the TBESS through ROS and make the claim through ROS no later than four months from the last day of the month to which the claim relates. For example, claim period September 2022 must be made by 31 January 2023.

Revenue will publish a list of the names and addresses of all businesses who avail of the TBESS. The list will include the total amounts they have claimed.

A TBESS payment will be taken into account when calculating the taxable trading profits of a business by reducing the amount of expenditure that can be deducted in arriving at taxable trading profits.

Registration for the TBESS is now open.

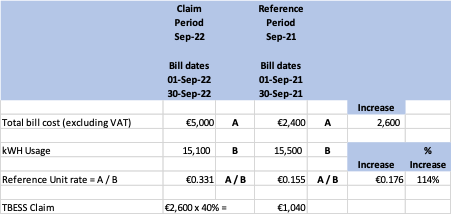

Example 1

In this example the bills fall in the calendar month. The average unit rate has increased by 114% from €0.155 to €0.331, so the business is eligible to make a claim. The amount that can be claimed is 40% of the increase in the bill from the reference period to the claim period.

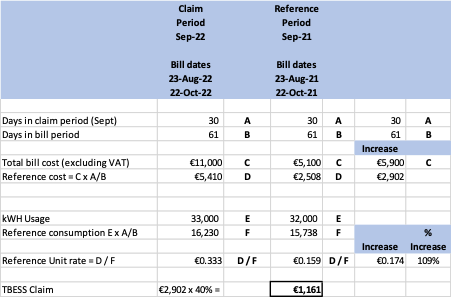

Example 2

In this example the billing period is longer than the reference period, so an adjustment must be made using a formula provided by Revenue as outlined below. Again, there is an increase in the unit rate of 109% so the company is eligible to claim a rebate of 40% of the increase in the reference cost.